Home loans resemble other financings in that there http://marcoeiyg862.fotosdefrases.com/sorts-of-home-mortgage is a particular amount obtained, a rate of interest paid to the loan provider, as well as a set number of years over which the funding must be paid back. Rather than paying out-of-pocket, a home mortgage lets you spread out the cost of your purchase over many years and also makes house acquiring far more cost effective. You see a promotion using a 30-year fixed-rate home mortgage at 7 percent with one factor. You see another ad providing a 30-year fixed-rate mortgage at 7 percent with no points. Possibly one of the most confusing things about mortgages and also other lendings is the calculation of passion. With variants in compounding, terms as well as other factors, it's hard to compare apples to apples when comparing home loans.

- We are compensated in exchange for positioning of funded items and also, services, or by you clicking specific web links published on our website.

- " Some really details cases, such as failure to pay real estate tax, can take priority over the first lien owner," Packer states.

- Your lending institution will maintain the cash for those costs in your escrow account.

- Over time, as you pay for the principal, you owe less rate of interest monthly, since your car loan equilibrium is lower.

Yet customers usually need to fulfill extra rigorous credit report as well as earnings demands to receive these home loans because they're not backed or insured by a federal government entity. In addition, customers with traditional financings that do not put down 20% are needed to pay exclusive home loan insurance coverage. You can drop PMI by refinancing once your home equity reaches 20%, or, in most cases, your funding servicer will immediately drop PMI once your home mortgage reaches a loan-to-value ratio of 78%.

Home loan payments typically consist of principal, rate of interest, taxes, and insurance policy. If all is well with the evaluation and also your application has gone smoothly, you'll obtain a mortgage offer at this phase. This offer will certainly verify that the loan provider enjoys to offer you the money as well as shows the payment terms. You'll after that pay this money back on a monthly basis for a set variety of years-- this is called a mortgage term.

Making An Application For A Mortgage

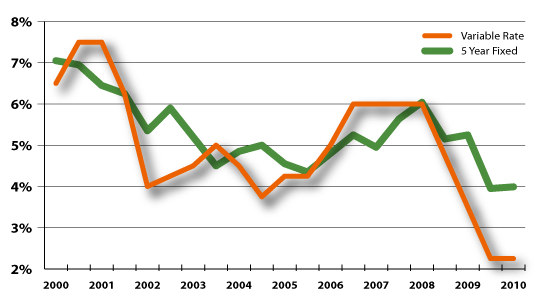

You can ask for a preapproval letter after you find a possible lending institution. The letter will certainly mention the optimum financing amount you're most likely to get. Being preapproved aids show to vendors that you're a major residence shopper, but it does not imply that you're assured to receive an actual finance. Flexible rates can work in your favor if rates go low, yet you might likewise end up paying more than your spending plan can take care of if rates of interest enhance. There's a cap on how much rates can fluctuate in many cases, yet even little jumps in your rates of interest can make your repayment much greater.

Points To Do Before Shopping For A Mortgage

Doretha Clemons, Ph.D., MBA, PMP, has been a company IT executive and also professor for 34 years. She is an accessory professor at Connecticut State Colleges & Colleges, foreclosed timeshares for sale Maryville College, as well as Indiana Wesleyan University. She is an Investor as well as principal at Bruised Reed Housing Real Estate Trust, as well as a State of Connecticut Home Renovation Certificate owner.

That restriction is $647,200 in many locations of the country, however is higher in high-cost locations, Alaska and also Hawaii. You can get a big home loan up to $2.5 million at Rocket Home mortgage. Your lending institution doesn't want the safety for the financing-- your possible house-- why you should never buy a timeshare to be worth much less than the financing quantity. While you're paying back the financing, the lending institution has a home mortgage lien on your house.