Table of ContentsSome Known Facts About Who Took Over Taylor Bean And Whitaker Mortgages.The Single Strategy To Use For How Long Are Most MortgagesThe Of Which Credit Report Is Used For MortgagesExcitement About How To Compare Mortgages

A fixed-rate mortgage needs the borrower to pay the very same rate of interest throughout the duration of the loan. Due to the fact that of this, property buyers will have the ability to prevent varying market trends. For the many part, this design of home mortgage comes with either a 15- or 30-year term. Some lenders may have exclusive terms, however.

Then, depending upon market changes, your rate will change usually on a yearly basis. That makes ARMs substantially more unpredictable than their fixed-rate counterpart. Here are a couple examples of ARMs: The "5" shows your initial rate will last for five years, while the "1" implies your rate will reset every year.

Aside from standard home loan types, government agencies offer their own loans to property buyers. 3 key government firms offer these services: the Federal Housing Administration (FHA), the U.S. Department of Farming (USDA) and the U.S. Department of Veterans Affairs (VA). FHA loans are distinct in that they permit homebuyers to pay just a 3.5% deposit, which is far below the standard 20%.

In fact, even those who have actually gone bankrupt can get approved. You can just obtain a USDA loan if you're aiming to purchase a house in a "rural area," which is designated by the USDA itself. These fixed-rate mortgages often come with no deposit whatsoever. Due to the fact that the VA offers these mortgages, they are entirely readily available to military service-members, retired service-members and some making it through military partners.

Jumbo loans are non-conforming home loans. This suggests that they don't fall within the maximum adhering loan limitations timeshare cancellation services federal government companies set. More particularly, loans for single-family homes are topped at $484,350. If your mortgage surpasses those bounds, you require to apply for a jumbo loan. If you're prepared to make the delve into homeownership, you'll likely need to get a home loan.

There's a wide range of business that fit under this heading, consisting of banks, cooperative credit union and online lenders, like Rocket Home mortgage and SoFi (which type of credit is usually used for cars). These loan providers can then be divided into 2 subcategories: retail loan providers and direct lending institutions. The only necessary difference in between them is that retail loan providers offer financial products beyond just home mortgages, while direct lenders focus on home mortgages.

Some Known Questions About How Do 2nd Mortgages Work.

Contrary to the massive technique used by home mortgage bankers, portfolio lenders provide their own money by their own guidelines. This might be useful, as these loan providers aren't bound by the exact same strict guidelines and investor interests that home loan bankers typically are. If you require a jumbo loan, it might be simpler to get one through a portfolio loan provider.

Home mortgages from these loan providers tend to have high rates of interest and minimum deposits, though (why do banks sell mortgages). As a result, investors looking to repair and turn residential or commercial properties on a short-term basis are their most common customers. Like their name indicates, wholesale loan providers supply funding loans to banks, mortgage brokers and other outside lenders.

Oftentimes, you'll see the name of the wholesale loan provider listed on your mortgage paperwork rather than your broker. Once your mortgage is total, a reporter lender will want to offer it to a sponsor, which is an external financier. In order to buy a loan, sponsors should ensure that it fulfills their criteria.

By selling the home loans, reporter lending institutions are essentially ensuring they earn money, as the possibility that a homebuyer defaults is removed. Home mortgages can be truly valuable if you wish to buy a house and can't pay for the total rate upfront. Though the types of lending institutions that offer them vary, it's ultimately approximately you to decide whether a particular mortgage, or lender, is for you.

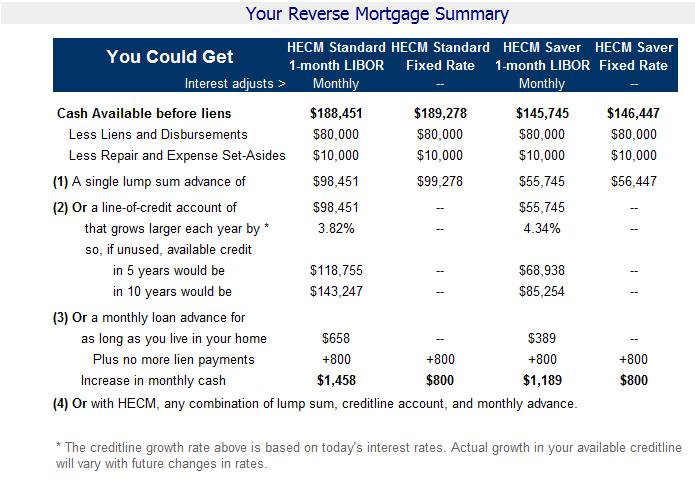

Did you understand you that if you're at least age 62, you can really obtain versus the equity you have on your home and utilize the extra cost savings to fund your retirement? This process includes a reverse mortgage. Often it's much better to look for skilled advice on monetary matters. If you're thinking long-term, think about dealing with a monetary advisor http://judahhrxd462.theglensecret.com/everything-about-who-does-reverse-mortgages to assist you draw up and handle all of your assets.

To get your matches, simply complete our fast personal financing survey about your current circumstance and objectives for the future. Picture credit: iStock.com/ BrianAJackson, iStock.com/ Ridofranz, iStock.com/ KatarzynaBialasiewicz.

Top Guidelines Of What Is The Current Interest Rate For Commercial Mortgages?

When you get a mortgage, your lender is paying you a large loan that you use to acquire a home. Due to the fact that of the risk it's taking on to issue you the mortgage, the loan provider likewise charges interest, which you'll need to repay in addition to the home loan. Interest is computed as a portion of the home loan quantity.

However if your home mortgage is an adjustable-rate home mortgage, your rates of interest could increase or decrease, depending upon market indexes. However interest also substances: unpaid interest accumulates to the mortgage principal, suggesting that you have to pay interest on interest. Over time, interest can cost nearly as much as the mortgage itself.

Home loan payments are structured so that interest is settled quicker, with the bulk of home mortgage payments in the very first half of your home loan term approaching interest. As the loan amortizes, more and more of the home mortgage payment approaches the principal and less toward its interest. Read on: Before you even request a mortgage, you have to get preapproved.

Once you're preapproved, you'll get a, which, in addition to your home mortgage quantity and any up-front costs, will likewise list your approximated rates of interest. (To see how your interst rate affects your monthly home loan payments, try our home mortgage calculator.) Preapproval is the very first step in the home loan process. After you lock down a home you like, you require to get authorized.

When you sign, these become what you have to pay. With a fixed-rate mortgage, your interest rate stays the very same throughout the life of the home mortgage. (Home mortgages generally last for 15 or thirty years, and payments must be made monthly.) While this suggests that your rates of interest can never increase, it also means that it might be greater usually than an adjustable-rate mortgage in time.

However, you typically get a certain variety of years at the start of the loan period during which the rate of interest is fixed. For instance, if you have a 7/1 ARM, you get 7 years at the repaired rate after which the rate can be adjusted when per year. This means your month-to-month home loan payment could go up or down to account for changes to the interest rate.

Fascination About Which Credit Report Is Used For Mortgages

Getting a mortgage is among the most considerable monetary choices the majority of us will ever make. So, it's important to comprehend what you're signing on for when you obtain money to purchase a home. A home loan is a loan from a bank or other monetary institution that assists a debtor purchase a house.

A home mortgage consists of 2 main aspects: primary and interest. The principal is the particular amount of cash the homebuyer obtains from a lending institution to acquire a home. If you buy a $100,000 house, for instance, and borrow all $100,000 from a lender, that's the primary owed. The interest is what the lending institution charges you to obtain that cash, states Robert Kirkland, senior house loaning consultant at JPMorgan Chase.